ESA 101: ESA’s can save the state money

This is part of a series of blogs focused on dispelling false information about Empowerment Scholarship Accounts

Opponents of school choice love to argue that innovative programs like Empowerment Scholarship Accounts (ESA) would have a negative financial impact on school districts in Missouri, but this argument does not hold true when you look at how proposed ESA programs would actually work.

Here is a quick primer on how ESA’s are funded and distributed to students:

Under the proposed ESA legislation, individuals and businesses would make a donation to a scholarship granting organization and in return would receive a tax credit. Those donations would then be used to grant scholarships to qualifying students who could use the funds to enroll in another school district, a charter school, a private school, or cover the costs of homeschooling.

So what does that mean for school finances?

At the local level, it means that a school district would not receive state funds for a student who is using a scholarship to attend another school. It also means that the local district is not responsible for educating the student or any of the costs associated with that education which would result in the district actually having more funding to serve their remaining students.

How does that work?

School districts in Missouri have two main sources of funding – the state and what is called local effort (i.e. property taxes). Schools receive funding from the state based on how many students they have in seats, so if they have fewer students they receive less funding. But they receive the same amount of local funding no matter how many students they have. So while districts would lose state funding for every student using an ESA their local funding would remain the same meaning that they have more local funding to spend on the remaining students while also eliminating the cost to educate the student receiving the ESA.

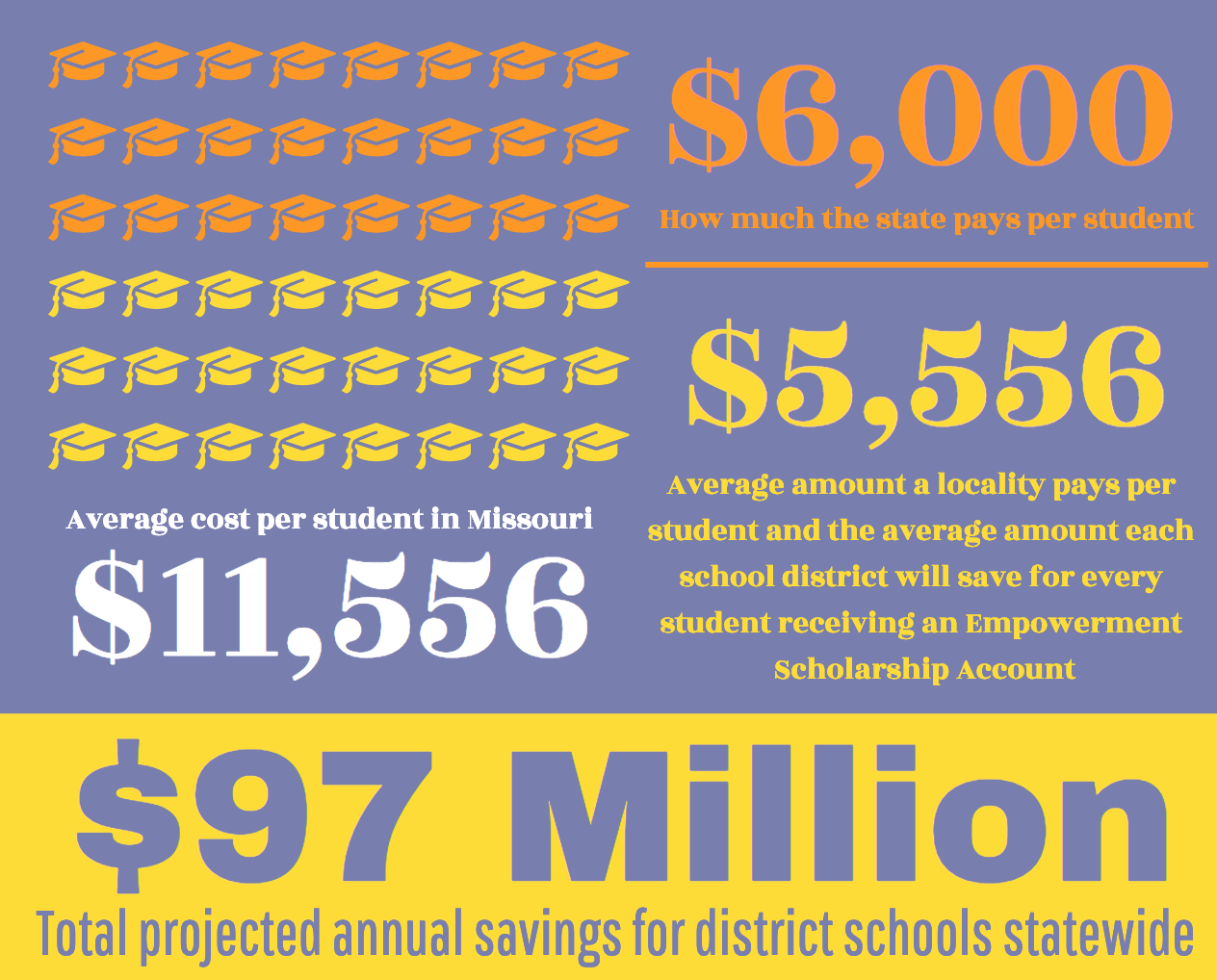

ESAs could save local districts over $97 million

In 2019, the Committee on Legislative Research Oversight Division estimated that a $50 million ESA program could result in over $97 million in savings for local districts with an estimated savings of $7,396 per student.

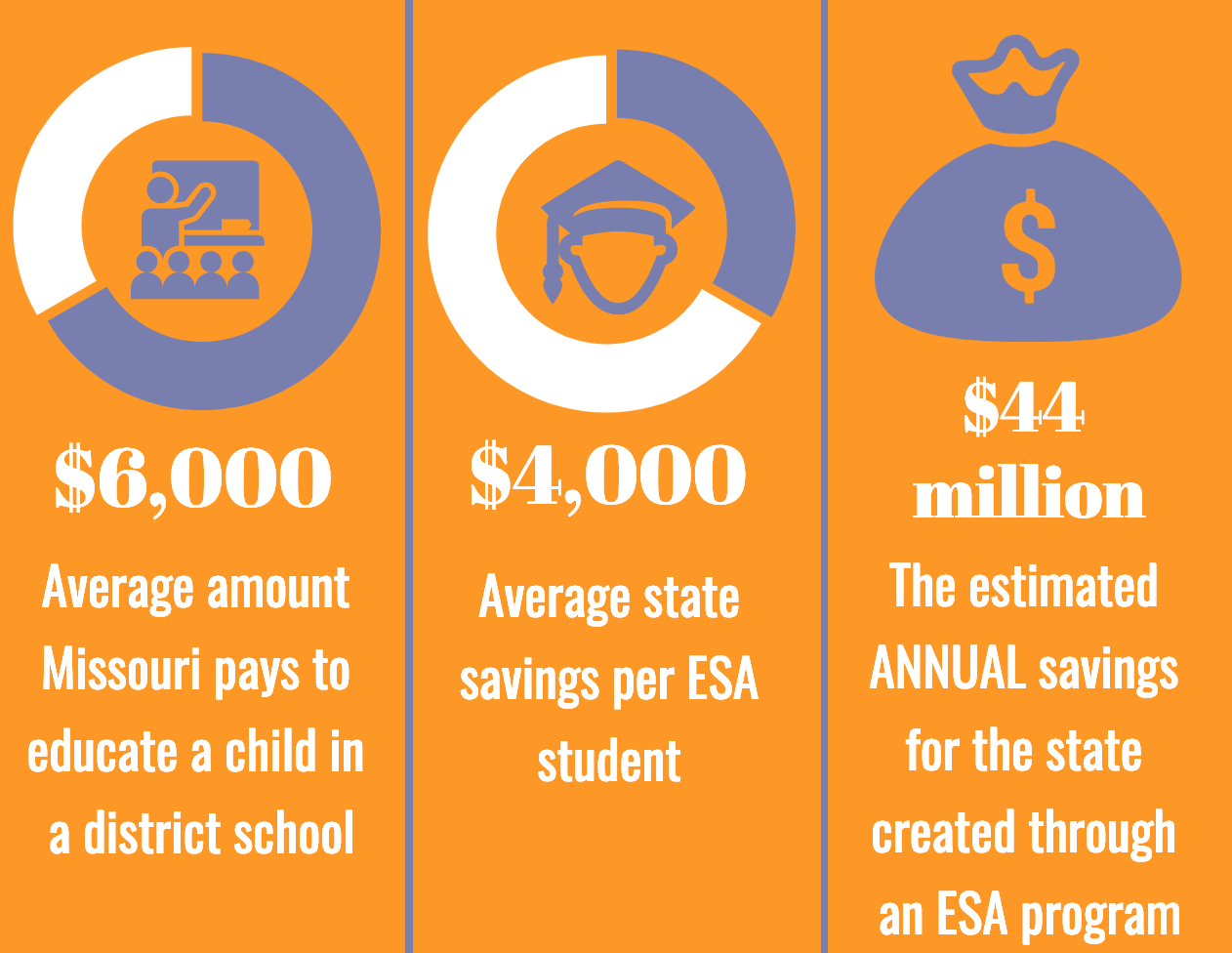

ESAs could save the state $44 million

The same 2019 fiscal note showed that ESAs would also result in major savings at the state level, estimating that a $50 million ESA program would result in over $44 million in savings for the state budget.

How does that work?

For every student receiving an ESA the state is no longer paying a local district to educate that student. The amount the state pays a district per student is called the State Adequacy Target (SAT) and is about $6,000. If every scholarship was for the full SAT amount then the impact on the budget would be limited because the state would be losing the cost of the scholarship in tax revenue ($6,000) but also saving the cost to educate the student ($6,000). The state is also responsible for administrative costs so the end result would be a negative impact on the state budget.

But if you look at how ESAs are used in other states and consider the cost of private education or homeschooling in Missouri then you quickly realize that it is unlikely that the scholarships would be for the full SAT amount.

In Iowa, for example, the average ESA scholarship is only $1,583 and in Florida, the average is $5,930.

The reality is that many families seeking other educational options only need a portion of the SAT to be able to afford those options. Most private schools offer their own tuition assistance or income-based tuition scales which means most families would only need an ESA to cover the difference, which could range from $1,000 to $5,000 per year. The savings are even greater for homeschooling which is estimated to cost from a couple of hundred dollars to $3,000 per year per student.

So if the average scholarship amount is $3,000 and the state is saving the cost of educating the student in a traditional district school ($6,000) then the state would save $3,000 per student.

Why are these savings not in the current fiscal notes?

Those paying close attention to school choice legislation in 2021 may wonder why the fiscal notes for proposed legislation does not show the same savings as in 2019.

The answer is simple. The Committee on Legislative Research Oversight Division is, for some reason, basing all of their calculations on every scholarship being granted at the full SAT amount.

But that is NOT required by the proposed legislation and not realistic when it comes to how the program would be administered.

The whole point of school choice legislation is to help as many students as possible access a high quality education. That means that scholarship granting organizations will not just be blindly handing out $6,000 checks, but instead only granting scholarships based on a family’s need so that they can offer as many scholarships as possible.

Simplifying the scholarship amount to the maximum allowed makes it easier for the Committee on Legislative Research Oversight Division to make their calculations, but it ignores the reality how the program would actually work and hides dramatic savings for the state.

« Previous Post: “This is not an education system this is a prison system for our children.”

» Next Post: ESA 101: ESA’s do not impact funding formula