ESA 101: ESA’s do not impact funding formula

This is part of a series of blogs focused on dispelling false information about Empowerment Scholarship Accounts

You might have seen some headlines or quotes in the media that proposed school choice legislation like Empowerment Scholarship Accounts (ESAs) will siphon off money from how much the state spends on local school districts.

This is simply not true.

School funding in Missouri is complicated, and proposed ESA legislation will have an impact on the state budget but there is no direct correlation between the impacts of an ESA and state funding for schools.

Here is a quick primer on how ESA’s are funded and how it impacts state funding:

Under the proposed ESA legislation, individuals and businesses would make a donation to a scholarship granting organization and in return, they would receive a tax credit. The amount of that tax credit varies in current proposed legislation, and may change as the legislation advances, but at the high end it could be up to a 100 percent tax credit.

That means that for every donation of $100 the state would lose $100 in tax revenue, so for a $100 million ESA program the state general revenue would be reduced by $100 million.

Savings outweigh expenditures

Of course, that simplistic calculation does not take into account the positive impacts that an ESA program could have on state expenditures. In 2019 the Committee on Legislative Research Oversight Division estimated that a $50 million ESA program would actually result in a net saving (even after accounting for the loss in state revenue) of $44 million.

But we don’t have to guess what the impact would be in Missouri, we can simply look to see what the impact of tax-credit-funded school choice programs have had in other states. Florida, for example, has operated one of the country’s largest tax-credit scholarship programs for years and frequent analysis has found that Florida saves $1.49 for every dollar invested in the program.

Funding formula not tied to revenue

Even if there were no savings realized through an ESA program, the loss in state revenue does not have a direct impact on how Missouri funds its schools.

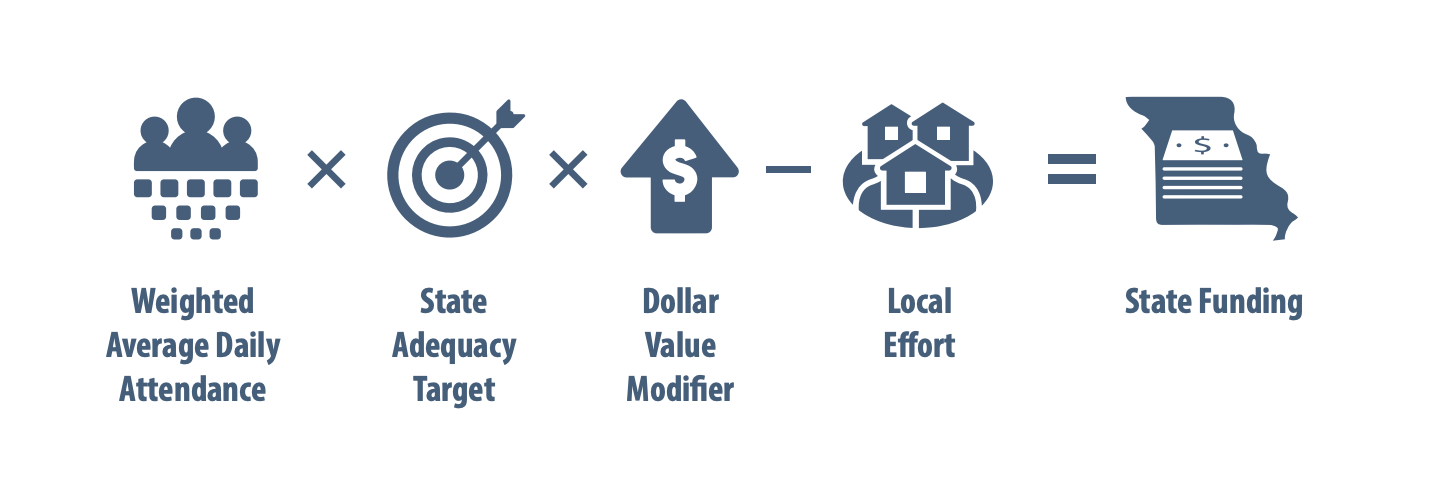

School funding in Missouri, at least at its current level, is not tied to state revenues, instead, it is based on a complicated calculation called the funding formula that takes into account how much the most affluent districts spend on education (called the State Adequacy Target), how many students are in the state public education system (Weighted Average Daily Attendance), the added cost to educate students in poverty or with special needs (Dollar Value Modifier) and how much each locality is expected to contribute.

The good news is you don’t have to understand the complicated formula to realize a basic fact: the amount of state funding required by the funding formula will be the same regardless of how much money the state takes in revenue each year.

Decreases in revenue do not mean decreases in school funding

As a result, decreases in state revenue do not necessarily mean that the state will fail to fully fund the funding formula.

Of course, any budget, whether it be your household budget or the state budget, requires a careful balancing of how much you are bringing in and how much you are spending, but Missouri lawmakers have made strong commitments to fully funding the formula and it is unlikely they would step back from that commitment.

In fact, Missouri lawmakers could even use some the savings that ESA’s would create to provide additional funding for schools by increasing the amount they pay for transportation or considering increases in teacher pay.

« Previous Post: ESA 101: ESA’s can save the state money

» Next Post: ESA 101: ESA’s have higher accountability than district schools