Transform Lives Today: Contribute to MOScholar’s 100% Tax Credit Scholarship!

Did you know it won’t cost you a dime to help more Missouri students access a high-quality education?

The new MOScholars scholarship program allows you to transform the money you already owe the state for income taxes into valuable K-12 private school scholarships for children in need.

3 things you need to know about the MOScholars tax-credit program:

- Earn a 100 % tax-credit by contributing today to MOScholars to ensure children can go to the school of their dreams this year.

- Get your contribution back when you file your taxes.

- Follow the simple steps below to claim your credit and help a low-income student or a student with special needs access a $6,375 K-12 education scholarship today.

A tax credit is even better than a deduction and can be used by anyone with a state income tax liability. It does not matter if you itemize or not on your taxes. The credit comes off your bottom-line amount due to the state.

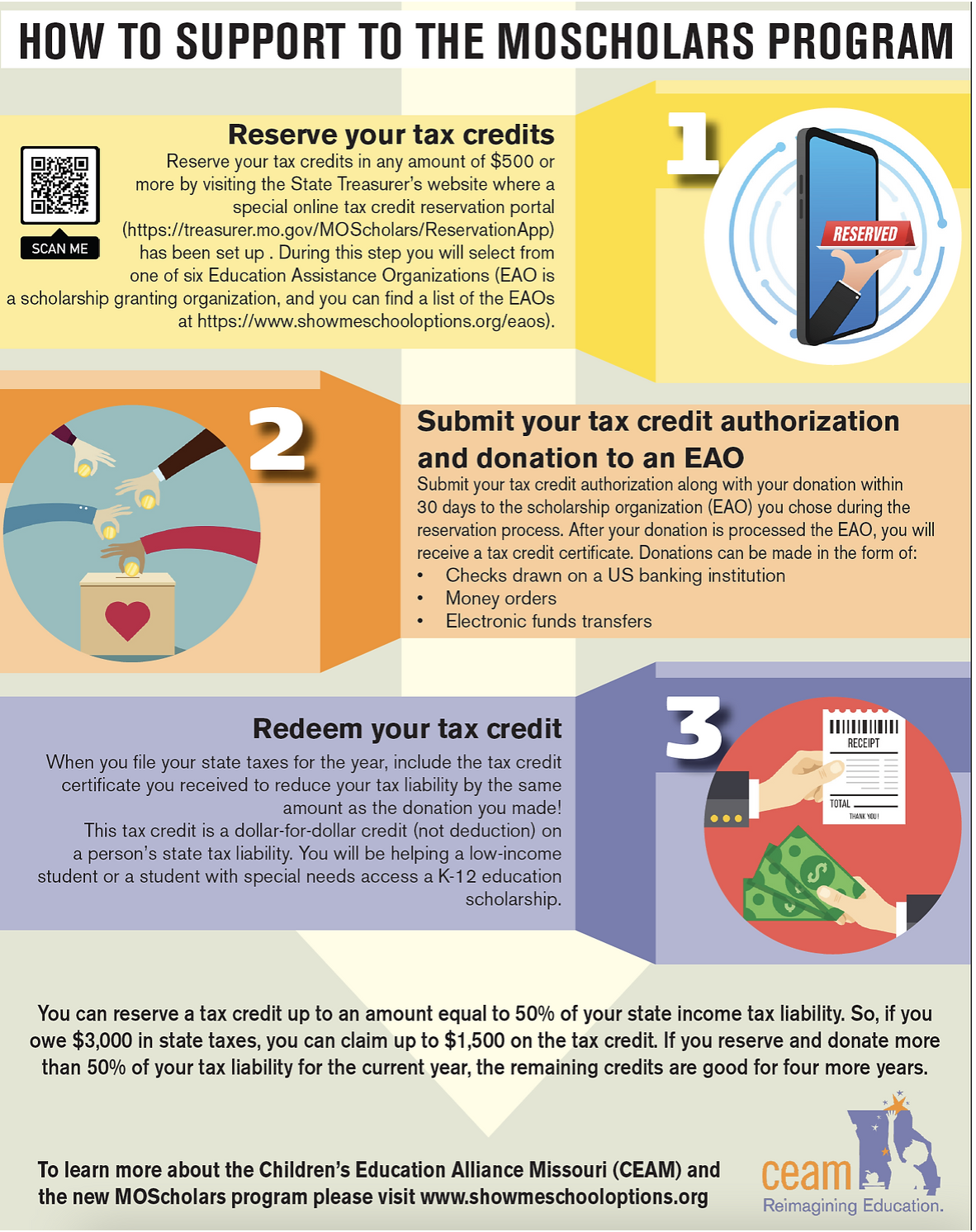

How to reserve your tax credit today!

- Reserve your tax credits – Reserve your tax credits in any amount of $500 or more by visiting the State Treasurer’s website (click the button below). During this step, you will select from one of six Education Assistance Organizations (EAO is a scholarship-granting organization).

- Submit your tax credit authorization along with your donation – Submit your tax credit authorization along with your donation within 30 days to the scholarship organization (EAO) you chose during the reservation process. After your donation is processed the EAO, you will receive a tax credit certificate.

- Claim your tax credit – When you file your state taxes for the year, include the tax credit certificate you received to reduce your tax liability by the same amount as the donation you made!

MOScholars tax-credit program open to all Missouri taxpayers

The best part of this new program is it is open to ANY Missouri taxpayer or business that pays over $1,000 in state taxes.

That means this program can be used by :

- An individual subject to state income tax;

- An individual, firm, partner in a firm, corporation or shareholder in an S-Corp doing business in the state and subject to state income tax; and,

- An express company that pays an annual tax on its gross receipts in Missouri under Chapter 153.

To learn more please visit https://www.showmeschooloptions.org/donors.