Fact Check: Counteracting more misinformation on ESAs

You would think that organizations designed to support the people responsible for educating our children would focus on sharing factual information and logical arguments, but groups trying to block students from accessing more educational options are once again spreading misinformation and logical fallacies.

Their most recent attempt is a document detailing talking points against HB349, a bill that passed the House two weeks ago and would create Missouri’s first-ever Empowerment Scholarship Account (ESA) program.

So let’s breakdown all of the wrong and misleading information they are trying to push to muddy public opinion on school choice legislation.

ESAs are not vouchers

The first major fallacy made in the anti-HB349 talking points “fact” sheet is describing an Empowerment Scholarship Account program as a voucher scheme. They do this because vouchers have a bad public opinion, but it creates a major issue when they are arguing against something that is not being proposed in Missouri.

ESAs are NOT vouchers. ESAs use no direct public funds to fund scholarships and any monies involved are given directly to families, not to schools. This gives families much more flexibility when it comes to picking an educational environment that works for their children.

HB349 will not negatively impact public school funding

The talking point document argues that:

“When Missouri’s budget situation is already extremely vulnerable, this program would divert hundreds of millions of dollars from the general revenue fund which would likely be used to fund the foundation formula or the school transportation categorical.”

The reality is that HB349 actually guarantees an increase in school transportation funding and provides districts with a 5-year hold-harmless clause that essentially provides districts with free money.

The version of HB349 passed by the House includes a requirement to fund school transportation at at least 40 percent in order for an ESA program to start or continue, a funding level that is a major increase over the 15% funding level in 2020.

Additionally, the passed version of the bill includes a hold harmless clause that would require the state to send state per-pupil funding each year for five years to districts for any student that receives an ESA and leaves the district. That means that local districts will receive state funding for five years for students that they no longer have any financial responsibility for educating totaling $31,875 in free money for each student that receives an ESA.

Existing 529 plans do not provide the options offered in HB349

The talking point document argues that:

Further, there is no need for this additional voucher expense due to changes in the tax code at the federal level. Indeed, when Congress made changes to the tax code in December of 2017, they permitted parents to receive a state tax deduction for private school tuition and other educational expenses at the K-12 level (via 529 Plans).

While the changes in the federal law in relation to 529 plans is beneficial to families, it is only a small benefit and does not provide any real help for low-income students seeking educational options.

The average tax savings per student using a 529 plan to pay for private school tuition would be $500, which would do nothing for a low-income family trying to find the funding to attend a private school. Additionally, the 529 plan is limited to school tuition, while HB349 would give families a wide range of educational options including helping to pay for homeschooling expenses or paying to send a student to a neighboring district or charter school.

The talking points also do not account for the savings that private schools create for the public school system.

Every student in a private school is one less student the public school system has to pay to educate. That means that every student in a private school saves the state over $6,000 each year (the amount the state pays districts per pupil) and saves local taxpayers the cost of building new school.

HB349 is designed to help those most in need

The talking point document argues that:

HB 349 Aids the Least in Need: Proponents of HB 349 state this voucher tax credit program will provide poor students the ability to have school choice by allowing them to attend private schools… This is false and very misleading. Indeed, the average annual private school tuition in Missouri is $10,132 per student. The maximum amount of voucher tax credit funds provided to a student in this bill is $6,375. Where would a low socio-economic family find the money to pay the additional $3,757 per year in tuition? Even if the private school tuition were just $6,000 per year, the additional $375 dollars in voucher tax credit funds will not cover additional costs with attending a private school. Who will provide transportation to the student to ensure they are able to attend the private school? Further, who will provide additional funding for the student for school lunches or to purchase a school uniform or all of the other additional costs that typically go along with attending a private school? This bill is instead for predominantly middle-class and upper-middle-class families who likely already have the ability to send their children to private schools

This argument is simply not true and is extremely disingenuous.

While the average total tuition in Missouri is $10,132, that figure does not take into account financial aid and sliding pay scales that most private schools already use to help low-income students attend their schools.

In reality tuition at some Missouri private schools can be as low as $1,085 per year and 47% of the schools used to generate the $10,132 tuition estimate have maximum tuitions of less than $6,000. While statewide data is hard to calculate, currently, over 30% of private school students in the St. Louis region receive some form of financial aid from their schools. For many students like them, an ESA scholarship would be used as part of a package of aid to make attending a private school a possibility, essentially providing “last mile” funding to complement existing financial aid and help those families cross the finish line of being able to afford tuition.

Indeed, fiscal notes on previous versions of this bill estimated that the scholarship amounts would only need to be between $3,000 and $4,000 to enable families to put together a funding package that would enable them to attend a private school.

The preponderance of evidence shows private school choice improves test scores across the board

The talking point document argues that:

Vouchers Don’t Work: Voucher programs have not been proven to aid student learning. In an analysis performed by the Center for Tax and Budget Accountability regarding the Indiana School Choice Scholarship Program in April of 2015, it was noted that “none of the independent studies performed on the most lauded and long-standing voucher programs in the U.S. – Milwaukee, Wisconsin; Cleveland, Ohio; and Washington, D.C. – found any statistical evidence that children who utilized vouchers performed better than children who did not and remained in the public schools.” The same group also noted that in a comprehensive study commissioned by the administration of Republican President George W. Bush, that students who attended traditional, K-12 public schools outperformed students who attended both charter schools and private religious schools, irrespective of denomination.

It is always a bad sign when your argument is based on only one study. In this case, the Missouri School Board Association tries to claim that private school choice legislation does not work because of a study that was actually largely funded by national teacher unions.

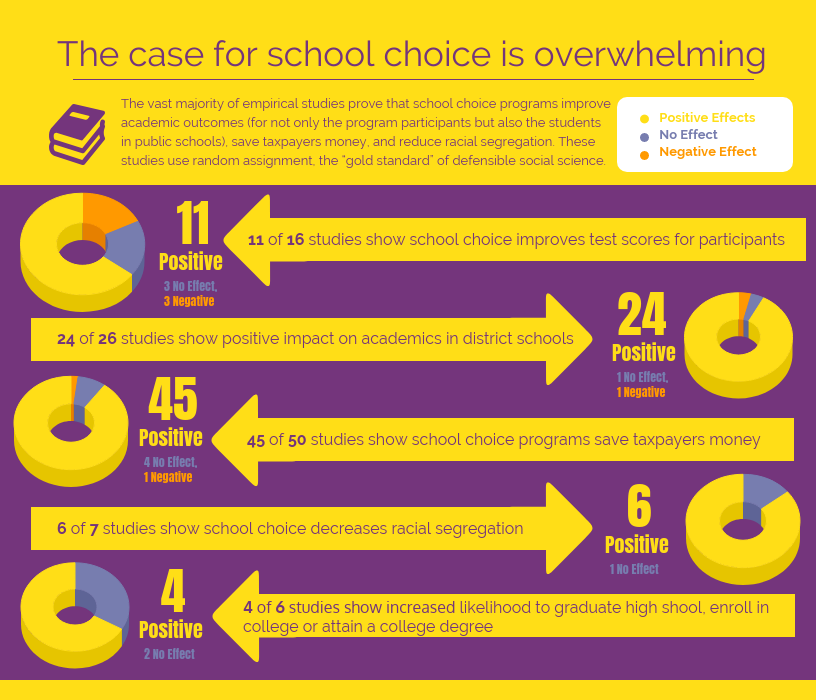

If they had bothered instead to look at the preponderance of peer-reviewed studies on the impact of private school choice they would have found very different results. In fact, a meta-analysis of studies on private school choice has shown participants see gains equivalent to an additional 49 days of learning in math and 28 more days of learning in ELA. The prevailing consensus, based on empirical research, is that school choice helps to improve test scores in both private and public schools, helps to lower the cost of education, helps to reduce racial segregation, and helps more students attend and graduate from college.

Private school choice creates the ultimate accountability

The talking point document argues that:

No Accountability: There is a total lack of accountability for the schools that are eligible to receive these taxpayer dollars in the bill. Unlike the public school system that must adhere to a significant amount of state and federal laws and regulations, these schools are free to act with impunity. Because private schools are free to act as they please, this inequity creates an unlevel playing field in which private schools are free to try new and innovative curriculum without fear of reprisal from the state if the curriculum failed to produce results. Presently, the bill does not contain provisions that would punish a private school for their students’ poor academic performance. Thus, no accountability.

This ignores the most important form of accountability — the ability for a family to take their students elsewhere if a school is not providing what they need to be successful.Who would ever argue that you should prevent anyone from using new and innovative curriculum, simply because some schools are not allowed to. If this is an issue in district schools then the education establishment should spend their time and money trying to make it possible for district schools to be more innovative instead of trying to block students from accessing schools that are already being innovative.

ESAs offer different forms of accountability than vouchers

The talking point document argues that:

Further, in a November 2017 report drafted by the United States Government Accountability Office (GAO), the federal government reviewed each active voucher program from around the country. In the report, the federal government noted which voucher programs adhered to basic accountability measures. After a review of HB 349, it is clear that if passed into law, it would be one of the most deregulated voucher programs in the country.

This is an easy argument to make because HB349 is not a voucher program. It is literally the definition of a straw man fallacy. It is not designed to require accountability from schools, instead, it gives families the power of choosing the school that most meets their needs. Because the scholarships are given directly to parents and not to schools, accountability measures are focused on the scholarship granting organizations instead of schools and when you look to those provisions there is accountability built into this law. The law requires the scholarship granting organization to provide the state with test scores from participating students, graduation rates from participating students, results from parent satisfaction surveys administered each year, as well as submitting to annual financial audits. The bill includes language to prevent families from using funding for non-education purposes including random, quarter, and annual reviews of how funds are used.

ESAs are designed to level the playing field NOT to create discrimination

The talking point document argues that:

Permits Discrimination: This voucher tax credit scheme permits private schools to accept public funds and then discriminate on the basis of disability, gender, religion, race, color and national origin as a private school is not required to alter its creed, practices, admissions, etc.

Again, funding goes directly to families, and while scholarship granting organizations are required to give preference to students with IEPs or low-income students, they are prevented from discriminating against who gets a scholarship based on disability, gender, religion, race, color, and national origin. The families can then choose to use the funds to attend whatever school they choose. If a school discriminates against their child in any way, then they simply would choose to send their child to another school and the discriminating school will not receive any of the scholarship funding. This argument is looking for a problem that does not exist.

Open enrollment is a good thing for Missouri students

Finally, the talking point document argues that:

Creates Open Enrollment: The bill contains an open enrollment provision which permits students to utilize the voucher to attend a public school that is not their resident district.

This is a good thing for Missouri families. Just look at how many families used the transfer program in the St. Louis region to access better education. If a school or school district is not meeting the needs of a child then to ensure that child’s success we need to give them the opportunity to find a school that does.

« Previous Post: Guest Blog: Understanding school choice from a teacher and a mom

» Next Post: ESA 101: Private schools and students with special needs